The last three weeks have proven to be one of the most volatile and painful times for stock investors. European indices from Germany to Italy were gripped with fear, losing more than 10 percent over this time period. By the 2nd week of October, the Dow Jones had wiped out its entire return for 2014. Even the Philippines was not spared, with the index falling as much as 3.8 percent for the week and breaking the crucial 7,000 level before recovering.

Global slowdown

The proximate cause behind the weakness in equities is the slowdown in global growth. In our previous presentations, we highlighted the ISIS conflict and the Russia-Ukraine crisis as key geopolitical risks that may affect global growth if left unabated. We said then that if sanctions against and from Russia escalate, then it is not only Europe’s growth that will be affected, but the rest of the world as well. Unfortunately, these fears did come to pass. ISIS continues to wreak havoc with thousands of people murdered, while Russia, Western Europe and the US remain in a cold war.

Too strong a dollar not welcome

Two weeks ago, we wrote about the strong dollar and its impact on different currencies (see It’s the strong dollar, stupid! Part II, Oct. 20, 2014). Commodity-exporting countries continue to suffer as their exports drop in value. Many other countries have voiced their apprehension over the sharp strengthening of the world’s reserve currency. Even the US has aired its concern over the strong dollar. In the Fed’s September minutes, Federal Reserve chairman Janet Yellen was quoted as saying that “further appreciation of the dollar could have adverse effects on growth.”

Epidemic of ebola

As these concerns over global growth grabbed headlines, another unforeseen threat reared its ugly head – ebola. First reported in 1976, this year’s ebola outbreak has been the deadliest yet, infecting more than 8,000 people and killing more than half of them. The epicenter of the current epidemic is in West Africa, with Liberia, Sierra Leone and Guinea bearing the brunt. Although one needs direct exposure to bodily fluids to get infected by this disease, research shows that the Ebola virus’ historical mortality rate is 70 percent.

Ebola exacerbates global slowdown

Then, two weeks ago, ebola hit US shores. After first going to a hospital in Texas due to fever, Thomas Duncan was reported to have been diagnosed with ebola after travelling from Liberia. Airports then began screening every passenger who came from Africa. People travelled less and screening procedures both in hospitals and airports became more stringent. Every time news on ebola would come out, short term stock traders would sell down. Thus, with news of ebola flooding the airwaves, equities in the US kept getting hammered repeatedly as traders feared that the worst is yet to come. Now faced with fear of the unknown, people ran for the exits, sending the Dow Jones down nearly 300 points on numerous occasions. This led to sharp corrections in equity indices around the world as ebola exacerbated fears of a global slowdown.

State of paranoia

At this point, the public was already in a state of paranoia. When a passenger on a plane bound for LA reported vomiting, the aircraft was put on lockdown. When a hospital in Boston admitted a patient with headaches and muscle aches, it was evacuated. Although both cases turned out to be negative for ebola, a different disease had already spread across the US – an epidemic of fear.

Outbreak of worry

Eventually, Duncan succumbed to the illness, but not before spreading the infection to the very health workers who were treating him. So when it was reported that one of his nurses was infected, jittery investors started to panic. The day after it was reported that a 2nd nurse was infected, markets sold off sharply. Equity indices around the world fell by nearly three percent on panic selling. With more questions than answers, an outbreak of worry ensued with many traders cashing out as they deemed that a global slowdown exacerbated by ebola was too much for them. The epidemic of ebola has now transformed into an epidemic of fear in capital markets.

The fear index

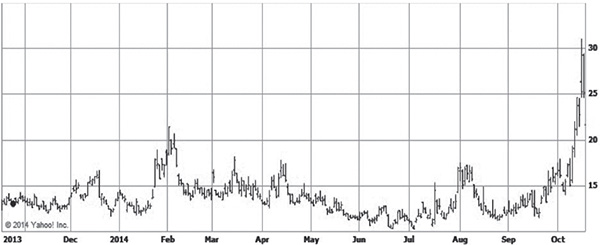

This outbreak of worry caused a breakout in the so-called “fear index.” The Chicago Board Options Exchange Volatility Index is a measure of the market’s expectation of stock market volatility. Also called by its ticker symbol VIX, it tends to spike during times of uncertainty. As fear over Ebola mounted, the 15 to 20 percent moves in the VIX became commonplace. Last week, the VIX spiked by as much as 30 percent within the day. On that same day, Oct. 15, the Dow Jones fell by 460 points before recovering much of its losses. See below a chart of the VIX. Note how it doubled, going from 15 to 31, in just one week.

CBOE Volatility Index (VIX)

Liquidity evaporates

During this three-week carnage, many equity indices fell by double-digit percentages. With fear engulfing the markets, buyers vanished and liquidity dried up. At one point, dark pools refused to accept orders. Many market pundits blamed the lack of liquidity on some trading days as the reason behind the stock market’s sharp drop. With barely any bids, panicky sellers would have no choice but to drive down the price if they want to exit their position.

Leveraged hedge funds forced to unwind

While some investors decided to sit tight and ride the volatility out, there were those who had no choice but to sell. If one was leveraged, the sharp drops in the past weeks are likely to have triggered margin calls. With leveraged hedge funds forced to sell their holdings immediately, prices fell precipitously, leading to even more margin calls. This vicious cycle continued for days as many traders just decided to capitulate as leverage began working against them, amplifying their losses. This reminded everyone of an oft-repeated saying in the stock market – “The market can stay irrational longer than you can stay liquid.” The Philippine market was no exception. Last week, we saw hedge funds forced to close out their position, giving orders to sell at market. This was more evident last Friday when they were giving orders to sell at any price at the close.

Buy when others are fearful

With all stocks, good and bad, sold down indiscriminately, many companies became too cheap to ignore. Those with cash and courage took advantage of the epidemic of fear and used it as an opportunity to buy stocks at bargain prices. Although one can never catch the bottom, it pays to buy when selling is borne out of panic and fear, not fundamentals. As legendary stock market investor Warren Buffett said, “Sell when others are greedy and buy when others are fearful.”

A rational and calculated approach

While fears of a global slowdown and ebola pandemic are not to be underestimated, we believe that the effects of these are temporary. In time, the market will get back to its senses and realize that their fears have been exaggerated. However, the market may continue to remain volatile, shaking the confidence of even the most stalwart investor. Thus, one has to pick stocks with good fundamentals and a solid growth trajectory that is insulated not only from ebola but the global slowdown as well. If one holds the right stocks, history shows that one will be able to withstand this temporary volatility. When the market is dropping because of an epidemic of fear, a rational and calculated approach to investing is warranted.

Please visit our online trading platform at www.wealthsec.com or call 634-5038 for detailed stock market research. You can also visit www.philequity.net to learn more about the Philequity Fund and view our archived articles. You can email us at feedback@philequity.net for feedback on the Philequity Corner articles.

No comments:

Post a Comment